Patient information

I am an AHSA health fund member. What does this mean for me?

We welcome all patients in Healthscope hospitals, whether we have a contract with their health fund or not. When the existing AHSA contract has terminated on Tuesday 4 March 2025, we enter a transitional period where the terms of the current contract will continue to apply to some patients. If Healthscope continues to remain out of contract with the AHSA beyond the transitional period, or the transitional period does not apply, you can still be treated in our hospitals, but you may face additional out of pocket costs. We remain ready to work with the AHSA to reach an agreement that sustainably funds our hospitals.

Your health fund is required to let you know about the impacts of this situation and you can discuss the specific details of your expected costs by contacting your AHSA fund (visit https://ahsa.au/our-funds/ for details).

Is it correct that I can avoid the additional out of pocket fees if I change my health fund? How?

Yes. Australia’s private health insurance laws allow members to move their cover to another health fund without re-serving waiting periods when transferring to a comparable product.* AHSA health fund members can avoid additional fees if they switch to a comparable product with another fund that has the same level of benefits and same conditions as their current product. Healthscope has agreements in place with all other major Australian health insurers including Bupa, HCF, Medibank and NIB.

Which other funds does Healthscope have contracts with?

Healthscope has agreements in place with all other major Australian health insurers including Bupa, HCF, Medibank and NIB.

If I stay with an AHSA health fund, what will my future out-of-pocket costs be?

We won’t know what these costs might be until AHSA funds advise us the amount they will to pay for their members’ treatment beyond this date. We expect this to happen just before the current contract comes to an end on Monday 3 March 2025.

Under guidelines set by the Private Health Insurance Ombudsman, doctors, hospitals and health funds are expected to work together to provide information to you about the costs associated with your treatment, and any private health insurance benefits payable, prior to your admission to hospital.

Scenarios

Maternity scenarios where an AHSA fund member patient WILL NOT need to pay out of pocket fees

The patient books before or on the 3 March 2025 for AHSA funds for maternity care and:

- is admitted before their due date for observation or complications such as dehydration, high blood pressure, etc.

- their due date is in within nine months of those dates.

- their baby/babies require admission to a special care nursery or neonatal intensive care unit after birth.

Mental health scenarios where an AHSA fund member patient WILL NOT need to pay out of pocket fees

Patients booking before or on 3 March 2025 for AHSA funds for inpatient treatment:

- General admission within six months of those dates (for example in May or June).

- Multiple general admissions, or EMDR admissions within six months of those dates.

Patients booking before or on 3 March 2025 for AHSA for outpatient treatment:

- Transcranial magnetic stimulation (TMS) treatment within six months of those dates. This only applies to previously contracted treatments, noting that TMS is not always a contracted service.

- Day program groups (open or closed) within six months of those dates. This must be for a currently contracted program or service.

Emergency scenarios where an AHSA fund member patient WILL NOT need to pay out of pocket fees

- A patient presents at emergency before or on 3 March 2025 for AHSA funds or within three months of those dates and is:

- At risk of serious morbidity or mortality and requiring urgent assessment and resuscitation.

- Suffering from suspected acute organ or system failure.

- Suffering from an illness or injury where the viability of function of a body part or organ is acutely threatened.

- Suffering from a drug overdose, toxic substance, or toxin effect.

- Experiencing severe psychiatric disturbance whereby the health of the patient or other people is at immediate risk.

- Suffering from severe pain where the viability or function of a body part or organ is suspected to be acutely threatened.

- Suffering acute significant haemorrhaging and requiring urgent assessment and treatment.

Other scenarios where an AHSA fund member patient WILL NOT need to pay out of pocket fees

- A patient is admitted for a procedure that has been booked before or on 3 March 2025 for AHSA funds, has the procedure and is readmitted within 7 days of discharge due to a related condition.

- A patient books before or on 3 March 2025 for AHSA funds for a procedure and the operation is cancelled, but then the operation is rescheduled within six months of those dates.

- A patient has been referred from their GP to a colorectal surgeon. The surgeon has booked the patient in for an endoscope before or on 3 March 2025 for AHSA funds. The patient has the endoscopy then requires bowel surgery which is performed one month after those dates.

- A patient has seen their ophthalmologist and requires cataract surgery on both eyes. The first procedure was booked in before or on 3 March 2025 for AHSA funds. The second procedure was booked in after those dates.

- A chemotherapy patient whose treatment ends but requires further treatment within six months of 3 March 2025 for AHSA funds.

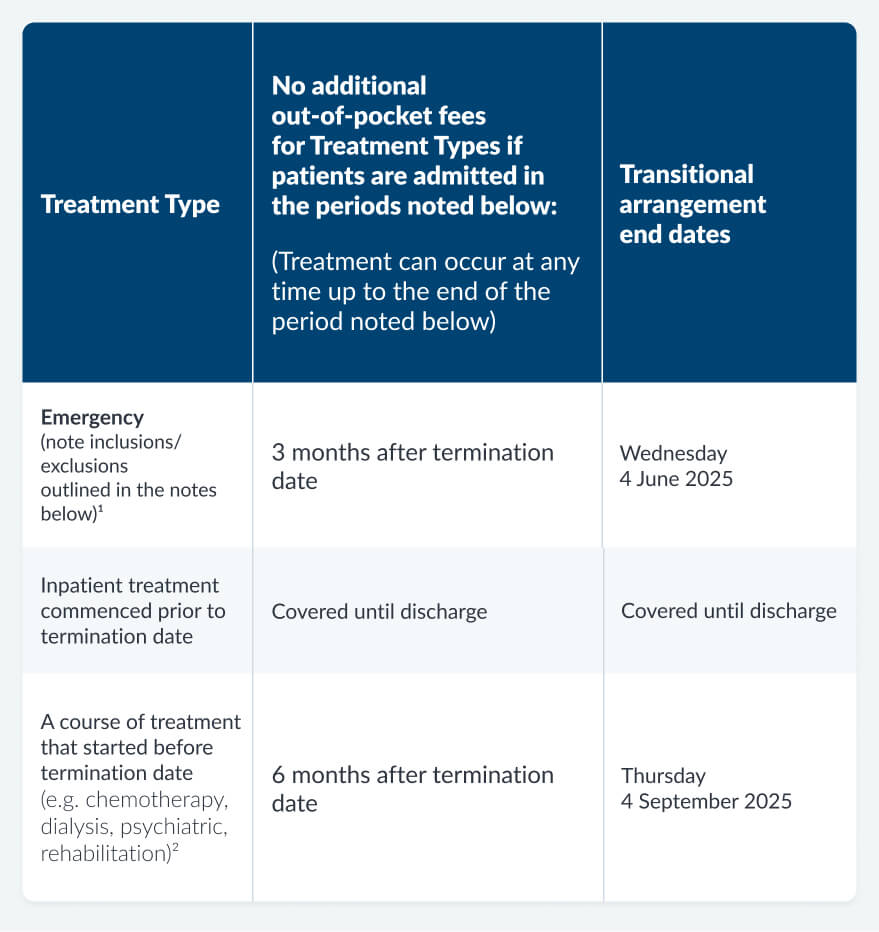

Transitional arrangements apply on and from Tuesday 4 March 2025 for AHSA fund members

1 Emergency admissions: the current contract arrangements and payment schedules continue to apply for a continuous period of three months. Emergency admission (in absence of any agreement) will include any of the following:

- At risk of serious morbidity or mortality and requiring urgent assessment and resuscitation.

- Suffering from suspected acute organ or system failure.

- Suffering from an illness or injury where the viability of function of a body part or organ is acutely threatened.

- Suffering from a drug overdose, toxic substance, or toxin effect.

- Experiencing severe psychiatric disturbance whereby the health of the patient or other people is at immediate risk.

- Suffering from severe pain where the viability or function of a body part or organ is suspected to be acutely threatened.

- Suffering acute significant haemorrhaging and requiring urgent assessment and treatment.

- Patient requires immediate admission to avoid imminent morbidity or mortality and where a transfer to another facility is impractical.

2 Course of treatment: all patients undertaking a course of treatment (e.g., chemotherapy, dialysis, psychiatric, rehabilitation) for a continuous period of up to six months. Course of treatment is not limited to the examples listed here.

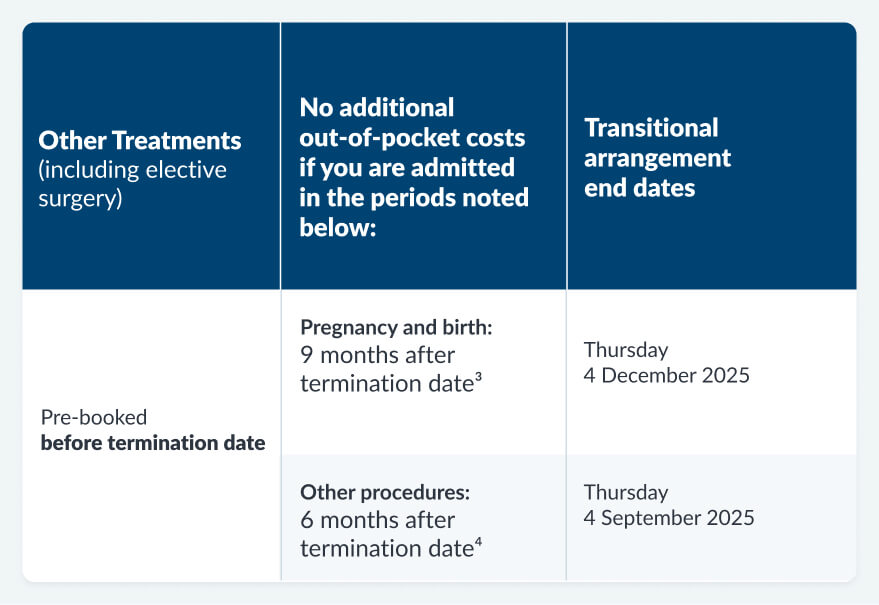

3 Maternity pre-bookings: if a booking has been received by the hospital prior to the contract termination date, including bookings notified by the doctor. If a pre-booked mother has a baby or multiple babies requiring admission to a special care nursery, this would be covered at the current contract rates. There may be exceptions where the baby requires ongoing treatment after being discharged from hospital. This would be deemed a separate admission and the rates payable would need to be confirmed with the AHSA.

4 Non-maternity pre-bookings: if a booking is received by the hospital prior to the contract expiration date, including bookings notified by the doctor or where the patient has completed the necessary forms. Admission must occur within six months of the contract expiration date.

If you are a patient who is an AHSA health fund member and you:

- meet the criteria in the table above, you will not be required to pay additional out of pocket fees;

- do not meet the criteria in the table above, it is likely that you will be required to pay additional out of pocket fees.

How can patients avoid extra fees?

Australia’s private health insurance laws allow members to move their cover to another health fund without re-serving waiting periods when transferring to a comparable product. AHSA health fund members can avoid additional fees if they switch to a comparable product with another fund that has the same level of benefits and same conditions as their current product.* Healthscope has agreements in place with all other major Australian health insurers including HCF, Medibank and NIB.

* Private health insurance is complex and it can be difficult to compare health insurance products. You should discuss your health insurance needs with the fund you are proposing to switch to so that you understand the new product, how it differs from your current product and can confirm that the product is right for you.

Make sure you consider the products excess, co-payment, full cost and all out of pocket expenses that will apply in the event you require treatment at a hospital. You should also consider if you are obtaining a comparable product. If you switch to a comparable product with another fund that has the same level of benefits and same conditions as your current product, you will not have to re-serve any waiting periods that have already been served.

You can compare funds for free at www.privatehealth.gov.au and choose a fund that is not affected.